special tax notice regarding plan payments

If you choose to have your Plan benefits PAID TO YOU You will receive only 80 of the payment because the Plan administrator is required to withhold 20 of the payment and send it to the IRS as income tax withholding which may be credited against your taxes. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS Alternative to IRS Safe Harbor Notice - For Participant To.

Printable Sample Power Of Attorney Sample Form Power Of Attorney Form Power Of Attorney Real Estate Forms

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice applies to distributions from ICMA-RCs 401a 401k and 457b plans I.

. Special Rules and Options III. Section I of this notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account with special tax rules in some employer plans. 5 You are receiving this notice because all or a portion of a payment that you.

Ad Affordable Reliable Services. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. If your payment from the Plan includes amounts from a designated Roth account please review the Special Tax Notice Regarding Plan Payments For.

You may be. Or an employer plan a tax-qualified plan section 403b plan or governmental section 457b. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS ROLLOVER OPTIONS Page 1 of 5 Start.

However if you receive the payment before age 59-1. And an eligible section 457b plan maintained by a governmental employer governmental 457 plan. Your payment will be taxed in the current year unless you roll it over.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS UNDER GOVERNMENTAL 401a PLANS. General Information About Rollovers II. IRA or an employer plan.

All references to the Code are references to the Internal Revenue Code of 1986 as amended. SPECIAL TAX NOTICE REGARDING RETIREMENT PLAN PAYMENTS v. If the Plan is an Employee Stock Ownership Plan dividends paid to you from the Plan cannot be rolled over.

Ad See If You Qualify For IRS Fresh Start Program. Special rules apply to the rollover of after-tax contributions and of Roth 401k 403. Free Case Review Begin Online.

Based On Circumstances You May Already Qualify For Tax Relief. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS YOUR ROLLOVER OPTIONS. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement plan savings in the Plan and.

If you also receive a payment from a designated Roth. 401k Plan Plan Date. See special note below for qualified public safety employees.

All references to ʺthe Codeʺ are references to the Internal Revenue Code of 1986 as amended. This notice summarizes only the federal not state or local tax rules which apply to Section 457b plan distribution. For the after-tax employee contributions and earnings on those contributions.

Take Advantage of Fresh Start Options. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement plan savings in the Plan and contains important information you will need before you decide how to receive your Plan benefits. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account with special tax rules in some employer plans.

This notice summarizes only the federal not state or local tax rules which apply to your. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to an IRA or an employer plan. If you are under age 59½ you will have to pay the 10 additional income tax on early distributions for any pre-tax payment from the Plan including amounts withheld for income tax that you do not roll over unless one of the exceptions listed below applies.

You may NOT roll over after-tax contributions from the Plan to a 403a annuity plan or to a governmental 457 plan. 3 You can roll over all or part of the payment by paying it to your IRA or to an eligible employer. Are eligible to receive from the Plan is eligible to be rolled over to an IRA or an employer plan or because all or a portion of your payment is eligible to.

Over to a Traditional IRA a Roth IRA or an employer plan. All references to the Code are references to the Internal Revenue Code of 1986 as. SPECIAL TAX NOTICE REGARDING OPERS PAYMENTS You are receiving this notice because all or a portion of a payment you are receiving from the Ohio Public Employees Retirement System OPERS is eligible to be rolled over to an IRA or an employer plan.

12218 ESOP dividends and amounts treated as distributed because of a prohibited allocation of S corporation stock under an ESOP. Stances payments from a 401qualified retirement plan may be eligible for special tax rules that could reduce the tax you owe. Roth 401k Assets Rules that apply to most payments from the Plan are.

A section 403b tax-sheltered annuity. All Major Categories Covered. A section 403a annuity plan.

In addition if the Plan holds S corporation. Owe 7500 or More Cant Pay Off. In the Plan and contains important information you will need before you decide how to receive your Plan benefits.

This notice is intended to help you decide whether to do such a rollover. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement savings in your employers 457. This notice is intended to help you decide whether to do such a rollover.

Select Popular Legal Forms Packages of Any Category. And an eligible 457b plan maintained by a governmental employer governmental 457b plan. Request a Free Quote Online.

Or if your payment is from a Designated Roth Account to a Roth IRA or Designated Roth Account in an employer plan. If you want to roll over your after-tax contributions to an employer plan that accepts these rollovers you cannot have the after-tax contributions. However if you receive the payment before age 59-12 you may have to pay an additional 10 tax.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement savings in the Plan and contains important. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account with special tax rules in some employer plans.

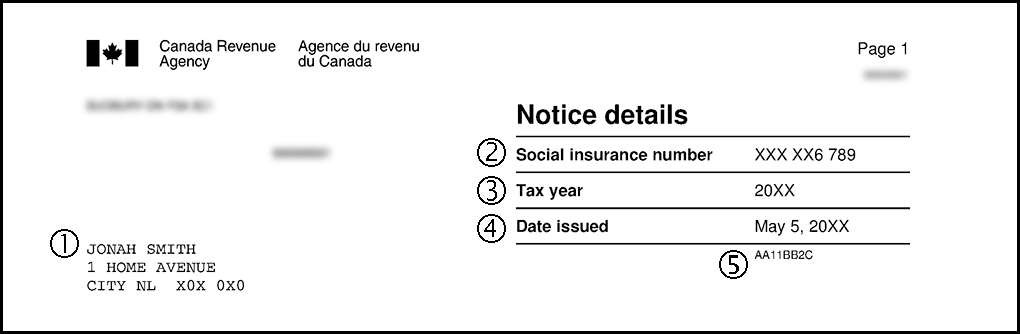

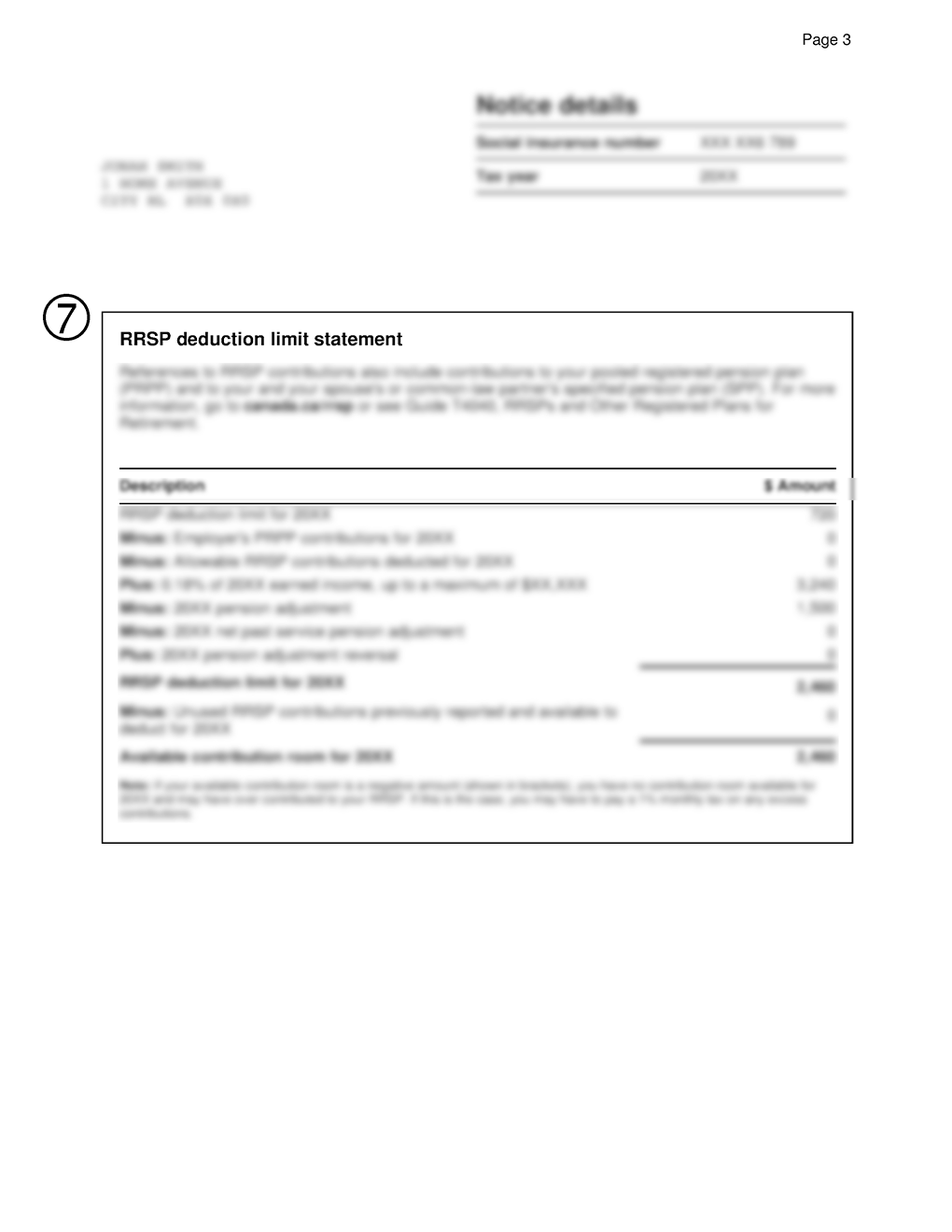

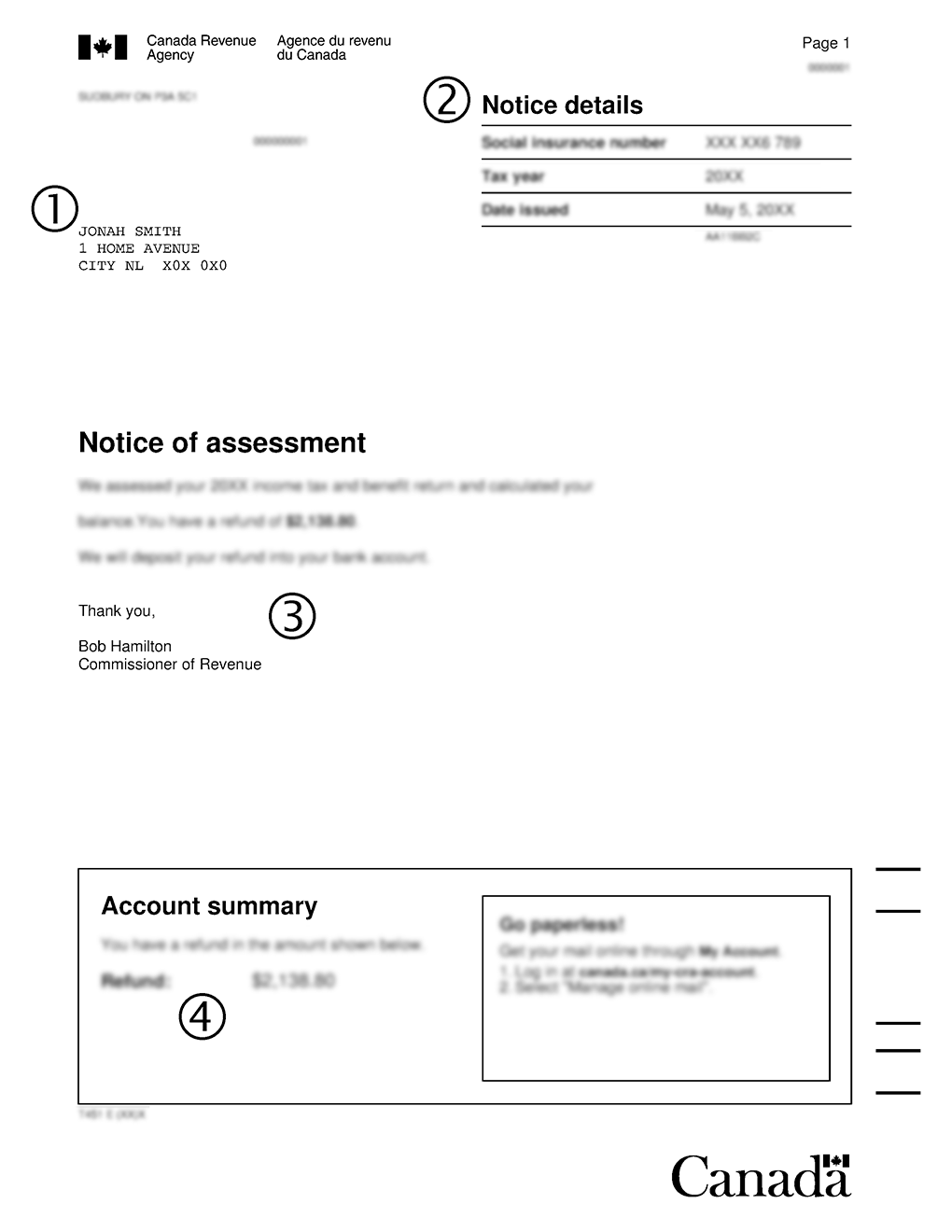

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Explore Our Image Of Eviction Notice Arizona Template Letter Templates Letter Template Word Rental Agreement Templates

Statutory Durable Power Of Attorney Template Google Docs Word Template Net

Reply To Third Party Sample Notice Legal Notice Legal Sample

Special Power Of Attorneyknow All Men By These Present That I Francis Oliver A Jabonete Filipino Power Of Attorney Form Power Of Attorney Real Estate Forms

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Free Termination Letter Template Letter Templates Lettering Introduction Letter

Private Loan Contract Template

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Search Results For Move Out Ezlandlordforms Being A Landlord Move Out Cleaning Cleaning Guide

Tenant Rules And Regulations Pdf Being A Landlord Property Management Tenants

Lease Agreement Being A Landlord Lease Agreement Free Printable

Letter Of Financial Hardship Mortgage Sample Letter Of Employment Lettering Letter Sample

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca